The Road to Financial Independence (Retirement Accounts)

When it comes to finances and investments, the topic can be complicated and new to many people. It is important to know ways that you can put your money to work and make smart financial decisions. I want to get to a point in my life where I am passive income coming in every month without me having to lift a finger. The road to retiring early starts with the mindset you have towards financial independence.

The world of finances can not be summarized in one blog post. However, there are tools and ways that one can utilize today in order to make a lasting impact. One way of putting your money to work is through the use of retirement accounts. This can be a job funded account such as a 401k, 401a, or 403b where you make contributions and your employer matches a set amount. A retirement account does not have to go through your employer. You can open your own retirement account through a brokerage like Vanguard, Fidelity, or Charles Schwab. In my case, I have a retirement account opened with my employer and in addition I have my own set retirement account.

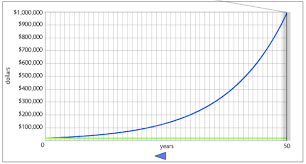

Roth IRA, possibly one of the best investing decisions I have made the past couple years. A Roth IRA (Individual Retirement Account) is a specialized retirement account where you pay taxes on money going into the account and then all future withdraws are tax free. This account allows you to put a maximum of $6,000 in contributions annually. Once you hit 50 you are then allowed a maximum amount of contributions of $7,000 annually. This way of investing is so powerful because over the span of 20 or 30 years your money is growing by the power of compound interest. This is when interest you earn on a balance in an account is reinvested earning you more interest. It is a phenomenon that allows small amounts of money grow into large amounts over time. Below you will find an exponential graph of how an annual contribution of $6,000 into a Roth IRA account can allow you to withdraw huge amounts of money tax free when you are in retirement.

Of course when talking about a Roth IRA and all the benefits it has to offer, we need to also include the disadvantages of having an account like this. As stated earlier, the maximum amount of contributions allowed in a Roth IRA is $6,000 annually unless you are over 50 years which then allows you to contribute $7,000 annually. You are restricted by the amount you can contribute. If you decided you wanted to put more than $6,000 you would not be able to do so. Another con in a Roth IRA is when you are able to withdraw your profits. In order to be able to withdraw your Roth IRA profits, you have to be at least 59 and a half years old. If you decided to withdraw the money that you contributed into the account, you are still able to do so tax free. However, the profits you have made are subject to a penalty if withdraw before the age of 59 and a half. This means if you contributed $6000 and by the end of the year your account balance now shows $9000, then you are able to withdraw $6,000 if you absolutely needed the money and you would be able to do so with no penalties. However, the other $3,000 that you made in profit from the stock market would be subject to a penalty.

Hello Lawrence,

ReplyDeleteI really appreciate your post. I found it very informative and helpful. Although I am not a Finance major... I do have a high interest in the finance sector. I'm an economics major studying quantitative analysis. I advocate pursuing financial stability through saving and investing.

I had a retirement started and cashed it out during 2020, as you know it was a rough year for many.

I want to start one again this next year after I graduate and although I already planned on getting a Roth IRA.... Your input gave me a better understanding.

Thank you!!

Hey Lawrence,

ReplyDeleteThis is some very solid financial information. My father is a financial advisor who specializes in retirement. Just like your post, he also taught me the importance of opening a retirement account early. In my BA 323 class, we truly saw the difference that compounding interest has on your investments and its crazy. I believe Einstein called it the 8th wonder of the world! Its cool to see that you apply what we learn in other classes to this one! Great post can't wait to read the next one!

- Ethan