The Road to Financial Independence (Dividends)

I am back with some more investing strategies to live a life of financial independence. In my previous blog I mentioned retirement accounts and how it is important to know different ways that you can put your money to work and make smart financial decisions. When it comes to investing you want to get to a point in your life where you can passively earn income every month without you having to lift a finger. Some people do this with real estate, where they rent out properties to tenants which pays for the monthly mortgage and a little extra on the side. This is certainty a great way to reach financial independence. However, it does come with its downsides. With the housing market being at an all time high, you may need large sums of cash to get started for a potentially overpriced piece of land. The stress of managing and fixing the property may be too much for some people.

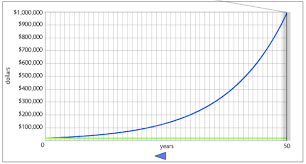

I have spoken to financial advisors, watched videos, and read many books about investing. The beautiful thing about reaching financial independence is that they're many ways of doing it. An effective way of building your portfolio safely is through dividends. A dividend is a sum of money paid by a company to its shareholders out of its profits or reserves. For example, lets say you purchase a share of Home Depot for $100, so you spent $100 in the stock market to purchase one share of Home Depot. What Home Depot will do is pay quarterly dividends to you for owning that one share. So, Home Depot will say "we have made all this money so we will give you $3 in dividends every quarter just for owning the stock without you selling it". Now, $3 may not sound like a lot of money, but this is what I like to call free money without you having to sell your stock. In addition we have the power of compound interest. This is when interest you earn is reinvested earning you more interest. It allows small amounts of money to grow into large amounts over time. Back to the Home Depot example, they gave you $3 for owning that one share which makes the dividend yield 3%. Lets say the following quarter (which is every three months) Home Depot increased that dividend from $3 to $4. Well now you are getting a 4% dividend and this is known as your yield on cost. Companies increase their dividends, you reinvest those dividends to buy more shares and it becomes a snowball effect that grows exponentially.

Of course when investing for dividends, not every company offers dividends and some of those companies may not be reputable. I make sure to invest in well established dividend companies such as Apple, Microsoft, Proctor & Gamble, PepsiCo, Johnson & Johnson, etc. Companies that are not going anywhere anytime soon. These companies are well established into economies with little competition. They have a great track record of paying and increasing dividends. It is important to do your own research when it comes to investments. I am glad I did because the world of dividend investing has so much more than what is in this blog. From index funds to payout ratios, to yields on cost. These words may seem foreign to you but once you get on the road of investing, it opens your eyes to safe investing strategies that will make you money.

Hello, thank you for these tips on financial independence. Investing definitely is not something that I am familiar with, but I have heard of its benefits. Reading this blog was a good reminder for me to make a retirement account because I know the longer you have It, the more money that it will create and compound. It seems like there is so much to investing so I don't really know where to start. It isn't something that I have learned about and I don't have any close friends that do it so I don't really know much about it. Although it would be nice to have another source of income! Maybe I'll have to look into it! -Naomi

ReplyDeleteHi,

ReplyDeleteI appreciate your posts on being financially independent. This is an important goal to me personally. I've done my best to study it on my own. I started a retirement and I have a Robinhood account. However, I still do get confused on how dividends work. Your post helped me see it a little clearer :)

Finance is so fascinating! Alot of people assume that I will know more about it since I'm an Economics student, but we don't really study finance all that much. Personally, I'm interested in pursuing properties as well, but I want to wait and see if the housing bubble bursts first.

I'm curious if you would have posted any other blogs about finance? I would have enjoyed reading them.